Shaping your Financial Success,

One Strategy at a Time.

We're not just about numbers and paperwork. We're your friendly neighborhood tax gurus, here to untangle the tax web and guide you towards a brighter financial future. No more stressing over tax season, no more confusing jargon – just straightforward solutions that work for you.

AZTEC

PHONE NUMBER

(702) 650-0235

Shaping your Financial Success, One Strategy at a Time.

We're not just about numbers and paperwork. We're your friendly neighborhood tax gurus, here to untangle the tax web and guide you towards a brighter financial future. No more stressing over tax season, no more confusing jargon – just straightforward solutions that work for you.

— About Us

Tax Planning Made Simple.

Taxes can be a puzzle, but we're here to put the pieces together. Our expert team will work closely with you to craft a personalized tax plan that maximizes your savings and minimizes your worries. Whether you're a small business owner, a freelancer, or a nine-to-fiver, we'll help you navigate the tax maze so you can keep more of your hard-earned money.

— Core Values

Tax Planning Core Values.

Asset Protection

Explore our comprehensive asset protection solutions. Safeguard your hard-earned wealth from potential risks and uncertainties, ensuring a secure and resilient financial future.

Tax Mitigation

Uncover expert techniques to minimize your tax liabilities. Our proactive strategies empower you to legally reduce taxes, preserving your earnings and accelerating your financial goals.

Wealth Building

Harness the power of strategic tax planning to cultivate and amplify your wealth. Navigate the complexities of taxation, turning them into opportunities for financial growth and prosperity.

Stress-Free Tax Preparation Wave goodbye to last-minute tax scrambles!

Our pain-free tax preparation service is designed to make tax time a breeze. No more sleepless nights or endless forms. Just bring us your documents, and we'll handle the rest. We'll ensure you get every deduction you deserve and file your taxes accurately and on time.

Business Taxes

We provide personal & business taxes services, and we file them for you on time.

Personal Taxes

We do fix my problem with your prior tax, trust Aztec Tax Solutions for a tax problem.

Renew ITINs

Do not wait, we will renew your ITIN on time for your next file tax, to get on time tax return.

Tax Audit & Audit Defense

We take care of your tax audit, with our expertise you will have the best results of it.

Financial Planning

Be always ready with our financial planning advice, and avoid any problems with the IRS.

Start Planning your retirement

We offer personalized retirement strategies tailored to your unique goals. From Traditional and Roth IRAs to 401(k) plans and annuities, we provide the expertise you need to build a secure and fulfilling future.

Retirement Plans

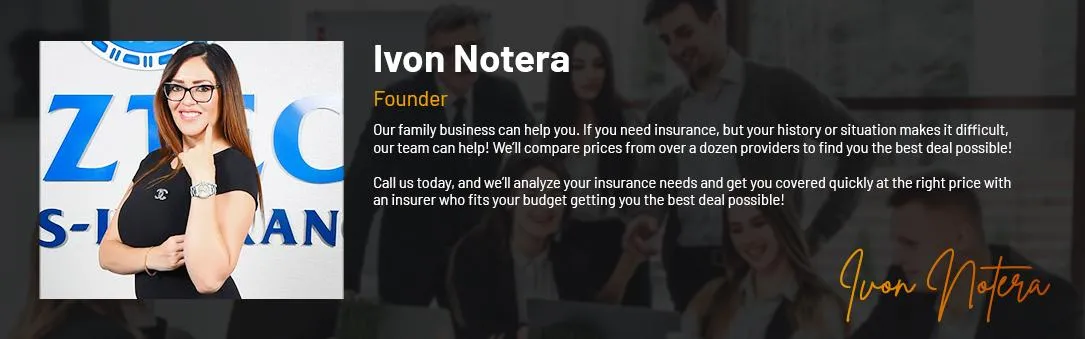

Planning for retirement is a critical step in ensuring a secure and comfortable future. At Aztec Taxes-Insurance, we offer a variety of retirement plans tailored to meet your individual needs and financial goals. Whether you’re an employee, a business owner, or self-employed, we provide expert guidance to help you navigate the complexities of retirement planning.

401k Rollovers

Changing jobs or nearing retirement? It's time to consider a 401(k) rollover. Rolling over your 401(k) into an IRA or another retirement plan can help you consolidate your retirement savings, gain more control over your investments, and potentially reduce fees. We make the rollover process easy and stress-free, ensuring you make the most of your hard-earned savings.

Life Insurance

Life is unpredictable, but you can provide financial security for your loved ones with the right life insurance plan. We offer a range of life insurance options designed to fit your unique needs and provide peace of mind. Whether you’re looking for term life, whole life, or universal life insurance, our experts are here to help you choose the best coverage to protect your family's future.

Executive Bonus Plan

An Executive Bonus Plan is a powerful tool for businesses looking to attract, reward, and retain top executives. We offer customized Executive Bonus Plans that provide key employees with valuable life insurance benefits while offering your business a tax-advantaged way to enhance compensation packages. This plan not only helps secure your company's future but also ensures your most important assets—your people—feel valued and motivated.